Western North Carolina First-Time & Low-Income Homebuyer Resource Guide

Credit Basics for Homebuyers

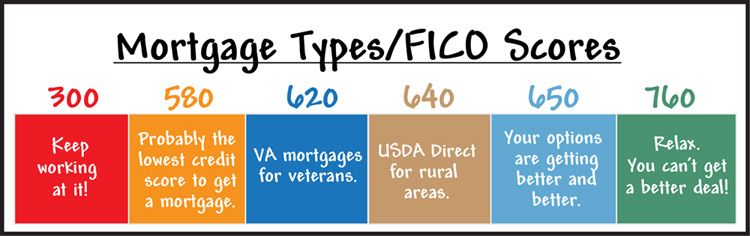

1. There are 3 FICO credit scores, one for each credit bureau. Lenders typically look at your middle FICO score to determine if you’re eligible for a mortgage and what interest rate to charge you. The lower the score, the higher the interest rate. Different mortgage products have different requirements. The following are typical credit score thresholds but they can vary a bit.

2. OnTrack WNC can help you build your scores.

- Get your credit reports through AnnualCreditReport.com or order a "soft pull" tri-merge credit report with FICO scores from all three bureaus from OnTrack for $35 by calling us, stopping by our office, or emailing info@ontrackwnc.org so we can send you an electronic authorization form.

- Want that score to be higher? Register for a free Credit Counseling Session.

Where to Find Affordable Mortgage Products

- Talk to at least three local lenders and compare APR as well as total finance costs. Your best offers may include FHA, VA, or USDA Guaranteed loans. They should also be able to connect you with many of the down payment assistance sources listed below.

- You won’t hear about USDA Direct from lenders because you get this one directly from the USDA. They offer no down payment and low interest rates for those buying outside the City of Asheville. Learn more about USDA Direct or call 828-254-0916.

Down Payment Help

There are several sources of assistance available for closing costs and down payment for those who qualify:

- Mountain Housing Opportunities – Down Payment Assistance – $20,000 to $30,000 in the form of a down payment assistance loan. Learn more about Mountain Housing’s program for Buncombe, Henderson, Haywood, and Madison Counties.

- NC Housing Finance Agency – Down payment assistance loan for up to $8000 or 5% of the primary mortgage amount. For more info, go to the NCHFA’s website or find a participating lender and ask them about NCHFA down payment assistance.

- Federal Home Loan Bank of Atlanta – Affordable Housing Programs – Sometimes offers down payment assistance or other affordable housing programs. Visit their website or contact one of the following local, participating lenders: BB&T, First Bank, HomeTrust Bank, Self-Help Credit Union.

- Down Payment Resource - This organization provides information about down payment assistance programs across the country. See what programs you're eligible for here!

Self-Build, Nonprofit and Government Programs

Several nonprofits in the area provide affordable homes in exchange for “sweat equity,” labor put in by the homebuyer to reduce the cost of the home. Other programs make homeownership affordable by leveraging housing voucher funds or through land lease structures.

- Habitat for Humanity

- Asheville Area Habitat for Humanity (for those who live or work in Buncombe or Madison County)

- Henderson County Habitat (for those who live or work in Henderson or Polk County)

- Haywood Habitat for Humanity (for residents of Haywood County)

- Transylvania Habitat for Humanity

- Mountain Housing Opportunities – serving Buncombe, Henderson, Madison and Haywood counties

- Asheville-Buncombe Community Land Trust - serving Buncombe county

- Housing Assistance Corporation - serving Henderson, Transylvania, and Polk counties

- Smoky Mountain Housing Partnership / Mountain Projects – serving Haywood and Jackson counties

- Housing Authority of the City of Asheville - if you have a housing voucher, you may be able to use it to make mortgage payments instead of rent payments! For more information, call the Housing Authority at 828.239.3536.

- Affordable WNC is a website that educates the public and complies affordable housing resources from across our region

Housing Discrimination

The Fair Housing Act protects many groups from housing discrimination.

Here’s How to Protect Yourself:

- Find a realtor who is comfortable spending time with you, will be honest with you, and will advocate for you.

- Shop around for your mortgage! Getting estimates from multiple sources is the only way of knowing if you are getting a fair deal.

- Suspicious? Call 2-1-1 for resources to help.

Want help with building credit, paying off debt, or buying a home?

Sign up for a free, one-on-one homebuyer counseling appointments by visiting our Individual Counseling web page. We require that you complete an intake form with information about your income and expenses before booking your appointment to give our counselors the information they need to prepare for your appointment. If you prefer to fill out the form on paper, call us at 828.255.5166, visit our office on the 2nd floor of the United Way building in downtown Asheville Mon-Thurs, or email us at info@ontrackwnc.org.

Know about a program we should add to this page? Let us know!